How much does Credit Background affect renting?

Credit Background affect renting?

In the United States, credit history (Credit Background) is closely related to the little things in life. Especially when renting a house in the United States, the building generally conducts background checks on students, of which credit history accounts for a large percentage.

Credit will also affect students' future credit card application, car purchase, job search, etc. Today, Mei Wo will take you to understand, what exactly does Credit Background mean?

-01-

Credit Score & SSN

When students apply for housing, the building will usually ask you for some relevant information to prove that you have a good credit record.

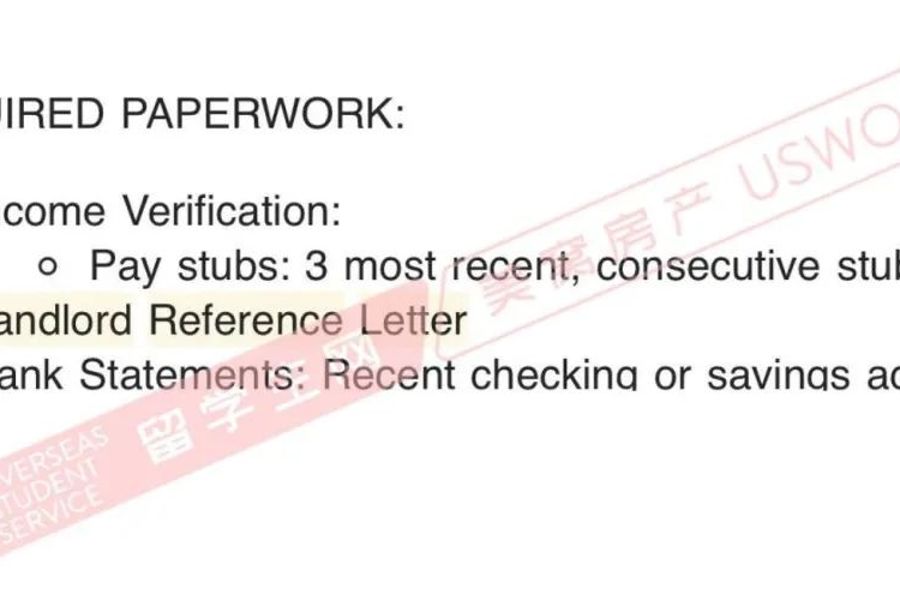

Students who have been in the U.S. for more than one year will be reviewed for historical records, including previous U.S. rent records, Bank Statements, and some buildings even require Provide the Reference Letter of the previous building.

If you already work and have your own SSN (Social Security Number). Congratulations, you have obtained this existence like an ID card.

However, if you want to get a Credit Score at the same time, you need to have a record of using a US credit card.

Generally speaking, if the Credit Score is 700 or above and the annual income can reach the monthly rent requirements of each building, it can be directly through the background tone of the building. Pay monthly rent.

-02-

Credit is not enough to guarantee!

Of course, many students who just came to the United States or have no work experience do not have so-called credit.

Or the Credit Score and Annual Earnings did not meet the review criteria because the time to get the SSN was too short. So if you want to pass the application smoothly, there are several solutions:

Guarantor

The easiest way is to find someone to guarantee, most buildings need to meet the conditions of working in the United States, and the annual income is 70-85 times the monthly rent. (*A few buildings require the guarantor to be American or hold a green card)

But at the same time, the guarantor will need to bear certain risks. For example, if the tenant does not pay the rent, the building has the right to ask the guarantor to claim compensation. And most importantly the guarantor must be responsible for the entire suite, not just one room.

Third Party Guarantee

In fact, it is difficult for most students to find a suitable guarantor. At this time, a third-party guarantor company is required.

Guarantee companies can help students provide proof to guarantee the tenant's credit, so that they can achieve monthly rent life.

Generally speaking, international students without Credit Background need to pay 70-90% of the monthly rent as commitment money to the guarantee company. Fulfill the guarantee. (depending on the building)

-03-

NJ no longer “cheap bowl”

The much-loved NJ is no longer “cheap bowls”, and the Qualified Requirements of some buildings have gradually become stricter, requiring payment Guarantee fee to move in.

There are also some NJ buildings that choose to have tenants pay an Extra Deposit in lieu of a security fee, typically 1.5 months' rent. But students don't have to worry too much, the building's deposit will be refunded after the lease expires.

In addition, some buildings in NJ also choose to let tenants pay half a year's rent in advance as credit protection.